The following explanation is long (and a little bit complicated), but we promise it’s worth your time to read and understand the relationship between your property assessment and taxes.

Budget basics

Every city’s budget is set separately from assessments. From a budget perspective, it doesn’t matter to a city whether assessments rise or fall, since the City doesn’t get more money when assessments increase. Seriously. Let us explain:

Expenses: Every year, cities determine annual costs for services (police, fire, parks, roads, etc.), considering increases for things like inflation (for example, wages, fuel, heat, insurance, etc. increase every year), service demand, and regulations from other levels of government. The cost of providing services typically goes up every year. That means the City needs more funds just to carry on as usual. City staff are always looking for ways to reduce those costs and find efficiencies in our processes but sometimes that is just not enough. In 2020 and 2021 taxes were not raised and that created some challenges in maintaining important services. We do our best to keep the tax rate low but to actually lower it might require the loss of services. City Council reviews services to balance low taxes with quality services during budget time.

Revenue: In B.C., cities collect taxes based on property value (assessment) set by BC Assessment. Assessments determine your share of city expenses. Our finance division calculates the tax rate needed to raise exactly the specified revenue needed for the budget. The tax rate (often called the “mill rate"), when multiplied by the total value of all the property in that class across the city, will equal the total revenue needed to be collected from that class of property (residential, commercial, industrial, etc.). Make sense? We told you it's complicated...

Let's break it down

Imagine a town with a $100 million budget. The town has 40,000 homes that BC Assessment has calculated to be valued between $200,000 and $2 million, with an average of $500,000. The municipality figures out each home's share based on their value (assessment). If the total value of all homes is $20 billion, the city calculates a tax rate (mill rate) to cover the budget. For example, if the rate is $5 per $1,000 of assessed value, a $500,000 home pays $2,500 in taxes.

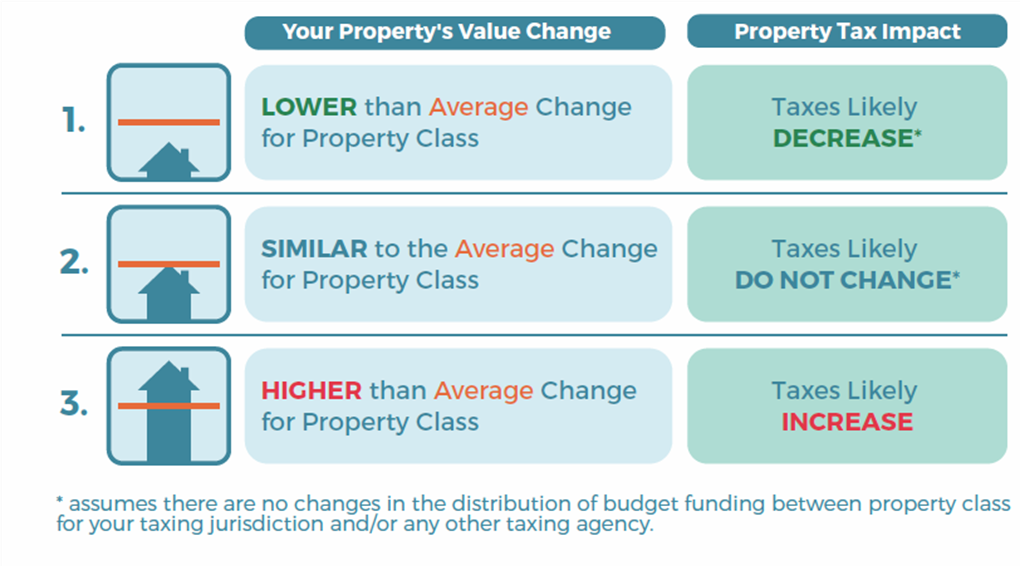

Now, if property values rise by 25% to $25 billion, the City recalculates the rate (now $4 per $1,000). If your home's value also rose by 25%, your taxes remain $2,500, as the city's budget didn't increase, and your property value increased by the average (see - sometimes it pays off to be average!). If your property's value rises less than average, your taxes might decrease. If it rises more, your taxes increase.

A city might impose a 3% tax increase. If your property value rises like the average, you face a 3% tax hike. Most properties will face assessment increases either higher or lower than the average.

Of course, this is a simplified explanation. In reality, it’s much trickier because commercial properties face higher tax rates, certain properties (like those owned by charities) are exempt, we institute parcel taxes, etc. New developments can also lower the tax rate since the City's costs are spread out over more properties BUT then the City has more expenses providing services to those new buildings. It's also important to remember that not all property taxes go to the city - we collect for other authorities too.

To summarize

- Higher property assessments ≠ more City revenue

- Assessments split tax bills, don't determine total tax

- Above-average increase = higher taxes

- Below-average assessment = potential savings

The City is not involved with property assessments. If you are concerned about your property assessment, the deadline to file an appeal with BC Assessment is January 31. Find more information on the BC Assessment website.